MoneyLoupe: Budget Planner

iPhone / Finance

MoneyLoupe: Your All-in-One Budget Book

MoneyLoupe is a comprehensive budgeting tool—serving as a budget planner, expense tracker, and account manager—all in one. From planning to reporting, the app streamlines expense tracking, saving, and cash flow management. MoneyLoupe supports multiple currencies and features stunning charts, printable reports, and detailed insights. It is designed to make budgeting as easy as pie, offering a ready-made template to help you manage your personal finances.

The goal is to provide a solid foundation for developing sound financial judgment. Embrace zero‑based budgeting and never let an unassigned cent slip through the cracks. With MoneyLoupe, you'll gain a better feel for making smart budgeting decisions. “No thinking, just acting” is the motto. Our zero-based budgeting approach encourages you to scrutinize every dollar and justify every expense, helping you avoid overspending and achieve your financial goals.

Entry

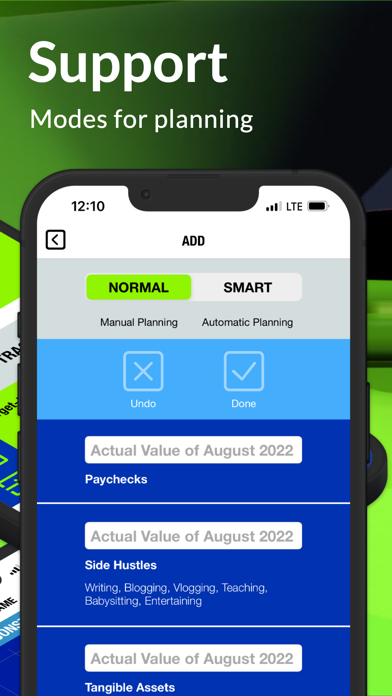

√ Planning with Modes

• Add planned income and expenses

• Edit planned income and expenses

• Default mode: Normal for beginners

• Defined mode: Smart after one year of planning

√ Handling Accounts

• Up to 16 asset accounts

• Customize each account with a title and opening balance

• Track credits, debits, and closing balances

• Edit, transfer, or delete accounts

√ Recording Income and Expenses

• 6 income categories

• 8 income subcategories

• 20 expense categories

• 54 expense subcategories

• For each entry, define amount, comment, category, subcategory, frequency, and associated account

Display

√ 4 Assistants

• Data Collector

• Account Manager

• Budget Planner

• Payment Tracker

√ 2 Accounting Methods

• Cash basis accounting

• Accrual accounting

√ 3 Currencies Supported

• Dollar

• Pound

• Euro

√ Statements and Changes

• Annual and monthly income statements

• Income category reports

• Annual and monthly expense statements

• Expense category reports

• Edit and delete income and expense entries

√ Double-Entry Bookkeeping

Export

• Income and expense statements (annual/monthly)

• Monthly category statements

• Target-actual comparisons

• Instruction manual

• Data transfer via AirDrop or email

• PDF export in US Letter or A4 format based on your region and selected currency

• Track receivables, payables, provisions, and reserves

• Conduct variance analysis

Tracking

√ Target-Actual Comparison

• Identify budget shortfalls and surpluses

• Maintain a monthly balance

√ Monthly Comparison

• Compare monthly income and expenses via charts

√ Zero-Sum Game

• Track your Zero-Sum progress

√ Adjustment Tools

• Bubble chart to visualize monthly constraints

• Adjustment button to show expected changes based on yearly constraints

• Solvency checker to verify closing balances of asset accounts

Support

• Notifications to guide and inform

• Quick-start guide: Your 50-Step Budgeting Journey

• Workflow presented as a step-by-step process

• 65-page downloadable documentation

• Q&A session available

The Zero-Based Budgeting Philosophy

Zero-based budgeting means allocating every dollar of your income to a purpose—whether it’s spending, saving, or debt repayment. Every cent must be accounted for.

If your total income equals your total expenses by year-end, congratulations—you’ve achieved a zero-sum budget and demonstrated control over your finances.

To stay on track, it's crucial to match income with expenses on a monthly basis. Even if you have $500 left over at the end of the month, your budgeting work isn't done until you assign those funds—ideally toward savings or debt reduction. Unassigned money is a missed opportunity.

Managing your finances this way pays off. People who adopt zero-based budgeting often find themselves with less debt and more savings. It's not about the amount you earn, but how you plan.

A sound budgeting method, combined with a reliable template, creates a winning formula. Don’t miss out on this advantage—choose MoneyLoupe’s all-in-one budget book.

Quoi de neuf dans la dernière version ?

Mandatory update of age information