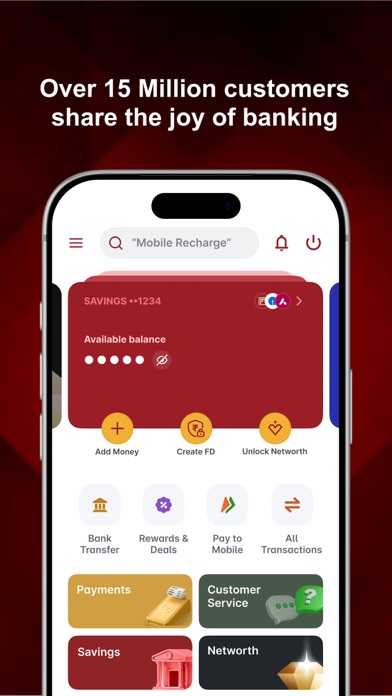

IDFC FIRST Bank: MobileBanking

iPhone / Finance

Welcome to IDFC FIRST Bank’s Mobile Banking App. Enjoy a fast and seamless online banking experience, with integrated banking services and exciting features.

Experience the joy of:

* One-Swipe Banking: Swipe to view your account balances & manage credit card/debit card details, deposits, investments, etc

* Instant Payments & Transfers: Make secure payments, UPI transfers, and bill payments

* Zero Fee Banking: Enjoy free Savings Account services, such as money transfers, cheque re-issuance, debit card issuance, and ATM withdrawals

* Tracking Expenses: Monitor cash flow with over 20 automatically categorised transaction types. Link FIRST WOW! & Digital Rupay Credit Card with UPI, earn cashback & rewards on every payment.

* Auto-Sweep Current Accounts: BRAVO Current Accounts with Auto-Sweep to FD for higher interest rates

* Building Wealth: One screen view of your investment portfolio. Get curated investment recommendations based on your risk profile

* Personalised Offers: Get exciting offers across dining, lifestyle, travel & more

* Instant Personal Loans: Avail pre-approved loan offers at attractive interest rates & flexible tenures

* Fixed Deposit: Open an FD in 3 quick steps. Invest online & get guaranteed returns.

Smart App Features and Services

1. Secure Fund Transfers & Payments

* Free fund transfers to any bank account without adding beneficiary

* Easy bill payment and recharge – mobile recharge, DTH & utility bills

* Earn up to 10X rewards on travel/shopping spends via credit cards, redeem anytime for exclusive discounts

* 3-click digital bill payments

* Zero fee money transfer (मनी ट्रांसफर) to bank accounts through IMPS, NEFT, or RTGS

* Send money, pay utility & credit card bills, loan EMIs, buy/recharge FASTag, using UPI

* Link bank (बैंक) accounts & view your savings account (बचत खाता) balances with UPI

2. Investment, Mutual Funds & IPOs App:

Explore online investment services:

* Invest in Mutual Funds online with Instant SIP

* Invest in equity, debt, large-cap & multi-cap

* Save tax with ELSS mutual funds

* Invest in Unit Linked Insurance Plans (ULIP) & Online Sovereign Gold Bonds

3. Insurance App:

Buy health, bike & car insurance through our app

4. Tripstacc Benefits

* Convenient in-app flight & hotel booking experience on the IDFC FIRST Bank mobile app, powered by Tripstacc

* ZERO convenience fees on flight booking & earn 20 bonus points for every ₹100 spent on hotel bookings

5. Other Banking Services:

* Apply for debit card & cheque book via app with nil charges.

* View filtered transactions & download Smart Statement + Digest

* Manage credit card payments, download statements, and redeem credit card (क्रेडिट कार्ड) rewards

* Quick purchase and recharge of FASTag

* Zero fee on DD & Pay order issuance & 3rd party withdrawals

* No ECS return fee & decline fee at ATMs for low funds

* Get personalised offers across loans

* One app login for retail, MSME, Customer Service, & Relationship Management

Steps to Download App & Open a Digital Banking Account (बैंक खाता):

* Download the banking app & click on open savings account (सेविंग्स अकाउंट)

* Register your details & get user ID & password

* Log in via user ID & password or mobile number & MPIN

* Set up Face ID or finger scanner (biometric) for easy log-in

* SIM Binding feature for secure banking (बैंकिंग)

Personal Loan Features:

Loan amount: ₹20,000 to ₹40 lakhs

Personal Loan Tenure: 6 to 60 months

Annual Percentage Rate: 11% to 28%

Representative Example:

Loan amount: ₹1,00,000

Loan Tenure: 12 months

Interest Rate (reducing): 20%

EMI Amount: ₹9,264

Total Interest Payable: ₹11,168

Processing Fee (incl GST): ₹3,499

Disbursed Loan Amount: ₹96,501

Total Amount Payable: ₹1,11,168

Total cost of Loan (Interest + Processing Fee): ₹14,667

Disclosure:

By downloading the IDFC FIRST Bank Mobile App, you agree to our Terms & Conditions, as well as IDFC FIRST Bank’s privacy policy. To go through the T&Cs, please visit https://www.idfcfirstbank.com/terms-and-conditions

Quoi de neuf dans la dernière version ?

For merchants:

* Faster, seamless Payment Gateway onboarding

* Request a POS device directly in the app

General bug fixes and enhancements!