Income Tax Calculator: TaxMode

iOS Universel / Finance

INCOME TAX CALCULATOR

TaxMode is a simple and powerful income tax planning app. It is updated for the One Big Beautiful Bill Act (OBBBA). The following are some of the key items are included among other modifications in this release-

1.Updated tax rates

2. Standard Deductions

3.Extra Seniors’ Deduction with limitations and phaseouts

4.Updated State and Local Tax (SALT) itemized deduction with limitations and phaseouts

5.Deduction for overtime income with limitations and phaseouts

6.Tip income deduction with its limitations and phaseouts

7.Child Tax Credit updated

8.Alternative Minimum Tax updated for inflation adjustments and Exemptions & Phaseout Thresholds

9. Updated for inflation adjusted capital gain threshold for 0 and 15% tax rate

10. Charitable contribution limitation for high earners at 37% bracket

Some key features of TaxMode include-

● Up-to-date with latest tax laws up to 2026 tax year

● Includes tax years 2026, 2025 & 2024

● Includes Qualified Business income deductions

● Automatic selection of applicable tax computations

● Automatic check for AMT applicability and analysis

● Computes Net Investment Income Tax

● Performs deductions and exemptions phase-out

● Additional Medicare Tax

● Computes Child Tax Credit

● Computes Earned Income Credit

● Quarterly Estimated Tax computations, report & IRS 1040ES form support*

● Analyze impact of specific deductions

● Summary or detailed data entry options*

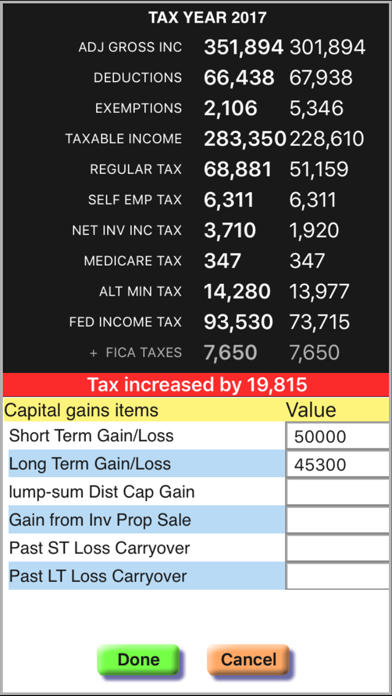

● Side by side comparison for what-if analysis*

● Ability to save and load data*

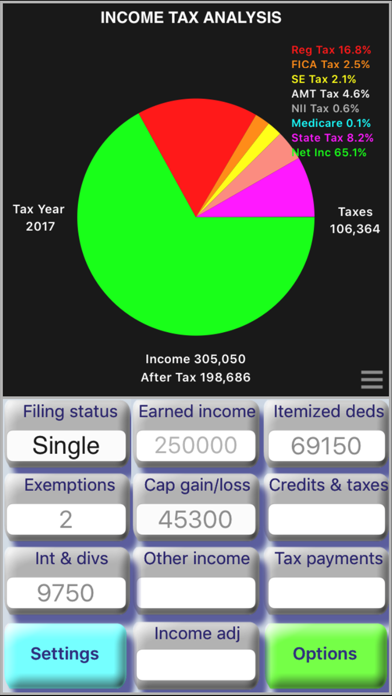

● Pie chart & multiple report options

● Supports computations with values for major IRS forms

● Effective tool for pre-tax return analysis

● Ability to email out results & reports*

● Easy data entry

● Import and export of plan data

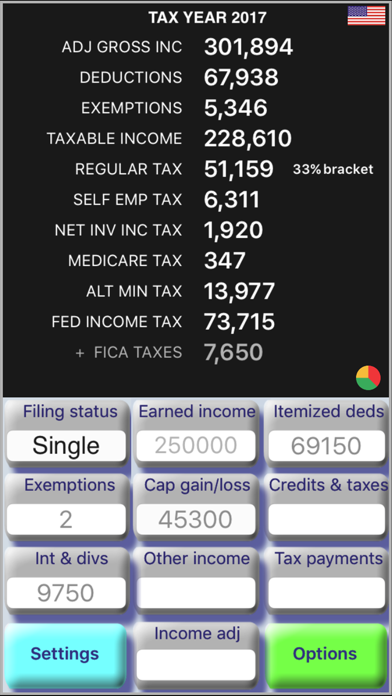

Tax calculations include-

● Regular income tax

● Qualified Business Income threshold and phase-out

● Pass-thru deductions from Specified and Non-specified business

● Tax based on QDCG worksheet

● Self-employment

● Alternative minimum tax

● Net investment income tax

● Additional Medicare tax

● Lump-sum distribution tax

● Child & Dependent Tax credit

● Earned income credit

● FICA taxes

Automatic limitation of amounts allowed for

● Medical expenses

● Investment interest deduction

● Charitable contributions with limitations for 60%, 35%, 30% & 20% deductibility

● Unreimbursed business expenses

● Casualty & theft losses

● Student loan interest deduction

● Tuition & fees deduction

TaxMode is a quick and efficient app for income tax planning. It provides an easy way to compute taxes and perform what-if analysis. It contains detailed implementation of USA tax laws for 2026, 2025 & 2024. TaxMode's capabilities can satisfy almost any level of need for tax computation, planning and analysis.

This app can be a valuable tool for professionals and nonprofessionals alike. For a tax professional it will enhance your analytical ability, improve your day to day productivity and make tax planning more efficient. For an independent individual, it provides an easy to use tool to analyze the tax impact of a transaction in terms of taxes saved or increase in tax liability, calculate a quick year-end tax estimate, perform a pre-tax-return-filing analysis, or review the impact of any other tax related investment decision; TaxMode can help you make more informed decision by providing a better understanding of all the possible income tax implications.

We hope you have a productive and satisfying experience with this app and delight us by giving TaxMode a helpful review.

Please let us know any thoughts or suggestions you may have while using TaxMode that will help us improve its functionality. Similarly, please write us at support@sawhney.com if you discover a computational error or have questions on a specific calculation.

Thank you.

*Represents a premium function

Quoi de neuf dans la dernière version ?

Ready for tax years 2026, 2025 & 2024 with latest IRS updates. It includes-

● New income tax rate tables

● Updated Standard Deductions

● Additional Seniors’ Deduction with limitations and phaseouts

● Updated State and Local Tax (SALT) itemized deduction with limitations and phaseouts. Details shown using IRS worksheet.

● Alternative Minimum Tax updated for inflation adjustments and Exemptions & Phaseout Thresholds

● Charitable contribution limitation for high earners at 37% bracket

● Additional deductions for Tips, Overtime and Car Loan Interest. Computations shown with supporting details